Head's up, there could be affiliate links ahead!

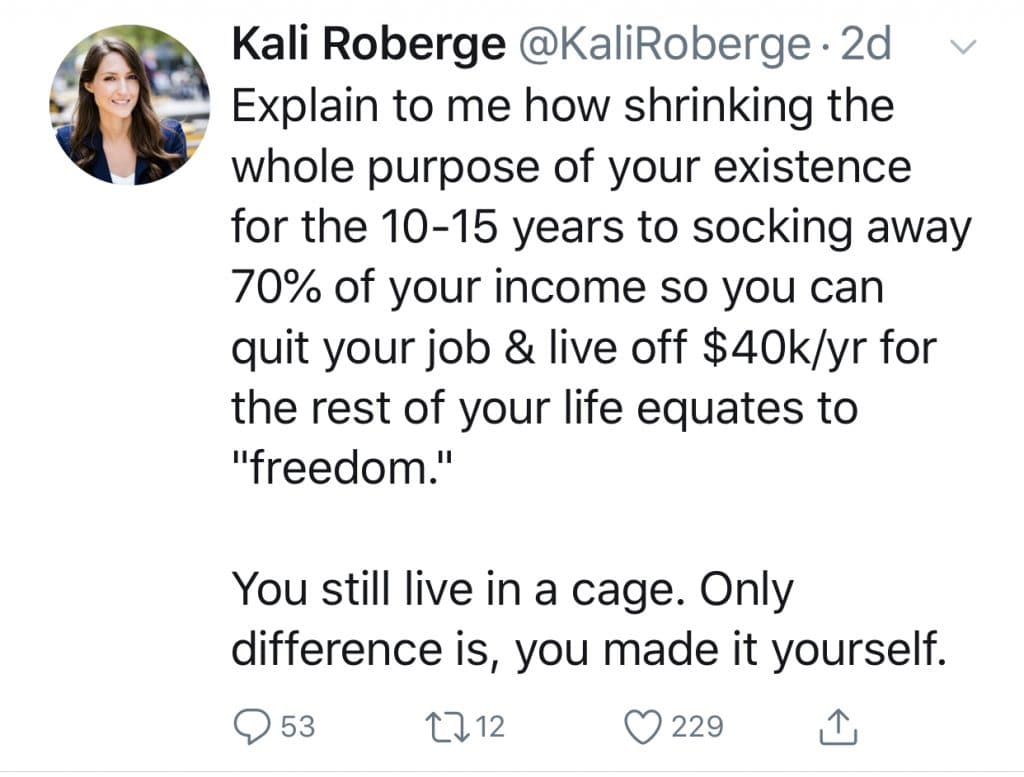

Can we talk about this for a sec? Because damn. That’s a #truthbomb that kicked me right in the gut when I read it on twitter the other day. Unlike Suzie Orman who claimed you can’t retire without $10 million unless you’re a public servant (explain that logic), this piece of wisdom made complete sense to me.

I Still Think the FIRE Movement is Great… In Theory

Now, while I’m still a huge an advocate for the FIRE movement, I lean more toward the first two letters of that acronym rather than the last two (financial independence vs retire early). This is partly because I’m probably too old for “early retirement”, but also because I agree that retiring in your 20’s or 30’s isn’t rational. In fact, in your 30’s and early 40’s your career is still just warming up, so to opt out of some of the most powerful earning years of your life, just so you can live off a small, guesstimated salary for the rest of your life doesn’t seem like freedom to me.

The Flaw In FIRE

The FIRE movement would argue that retiring early just means you’re retiring from your professional career so you’re free to pursue other opportunities (money generating or otherwise) with your time. But then that begs the question – why are we signing up for careers we can’t wait to be finished

Would it not make more sense to focus your time and energy on finding a career that’s fulfilling and sustainable rather than focusing all your effort on trying to escape the one you hate?

Why Early Retirement is Naive

I think a big part of that answer is that we’re so young when we start our professional lives, it’s hard to know what the ideal career pursuit is because we lack self-awareness and life experience. So we opt for what we “think” makes sense and also, what’s available to us. But that’s the very reason why retiring in your 20’s and ’30s probably isn’t a great idea, either. At that point, you’re still developing a sense of self and a library of personal experiences that will shape you in years to come. To assume in your thirties that you’ll be a-okay living in a trailer on 40K per year for the rest of your life is naive.

So Should You Still Pursue FIRE? Heck Ya!

I’m not suggesting that starting early to save for retirement isn’t smart. It’s probably the smartest thing a young person can do besides saying no to drugs and cigarettes. However, the FIRE movement can invoke a rabid behavior where saving money becomes the sole focus of living to the point of misery. Personally, I think that’s a ridiculous waste of precious life and yet, I hear it in many of the FIRE stories I come across.

I’m sure that’s not true of all FIRE enthusiasts, but I do think we can get a little over-zealous when fueled by a desperate need to escape a job we don’t like (been there, done that). In fact, in the first few months of my FIRE/minimalist journey, I accidentally tossed out all my immigration papers in a flurry of purges and bought a car I now regret purchasing, just because I thought it would get me to FIRE sooner. Rookie mistakes.

The Chill Route to FIRE

Now my approach to FIRE (or

Gaining FIRE is a Lot Like Losing Weight

I find that getting on the FIRE bandwagon is a lot like becoming a fitness enthusiast after years of being a couch potato. You realize how amazing it feels to be fit and all the ways it changes your life for the better, so you over-index on it because too much of a good thing is great until it’s not.

Then one day, after far too much obsessive dieting to keep those 6-pack abs visible, you realize that it’s much more fun to live with balance and moderation, so you stop with the obsessive dieting and hardcore workouts and opt for something more sustainable and enjoyable. Saving money is no different. We almost have to go too far so that we can find the boundaries that are right for each of us individually.

It’s like a pendulum that swings from one extreme to another. Eventually, it slows down and finds a resting point in the middle.

So where are you on that swinging scale?

Leave a Comment