Head's up, there could be affiliate links ahead!

Here’s the thing about Retirement – it has a stigma attached to it. It conjures up images of an attractive older couple on a beach wearing rolled up khakis and fisherman sweaters looking all happy and old. That’s so not what I’m talking about because first off, I’d never wear khakis.

Actually, to me, retirement has nothing to do with old people on beaches, khakis or even Medicare and annuities. It’s really just freedom.

[bctt tweet=”Retiring in your 40’s: Yes, it’s possible, but let’s call it something else. #fire #savemoney #betterlifenow” username=”@fundinghappy”]

Freedom to do what I want

Freedom to be who I want

Freedom to live where I want

Freedom to wake up when I want

Freedom to explore new hobbies, take vacations where and when I chose and basically live like a toddler without parental rules.

At its core, retirement is simply about shifting your priorities from paid work to no work or work that you chose to do. Nothing else really changes. Certainly in the “olden days” retirement was finite because people didn’t have side hustles or even the internet to keep them connected and engaged. So when you stopped working, life became a series of golf games and park bench warming.

Sidebar – when exactly did the “olden days” end btw? Are we officially in the “new-ish days” now?

Rebranding Retirement as “Phase 2”

But now retirement is not just for old people. It’s for anyone who wants more than the traditional work trajectory where you put up with traditional employment until you’re 65. Many people are retiring early – like, in their 30s and 40’s. They may still have income generating work to keep them afloat, but they’ve opted out of the house/car/J.Crew lifestyle in order to buy back their time and freedom. That’s why I think the whole concept needs a rebrand and a new name that’s more inclusive. I like the phrase, “Phase 2” because it implies a right of passage, but also doesn’t make you think of old people in khakis.

Are you Ready for Phase 2?

New name or not, Phase 2 still requires that you have a nest egg that will enable you to live comfortably off your investments with perhaps some minor income supplementation. Note: if you have to hold down 4 or more side hustles in your post-corporate life just to support yourself, you’re not really in phase 2, you’ve just digressed the quality of your income. But if you’ve got an income generating portfolio that’s not quite enough to support you full time yet, then a little side hustle may just be what you need to bring your Phase 2 date closer to reality.

How Far Are you From Phase 2?

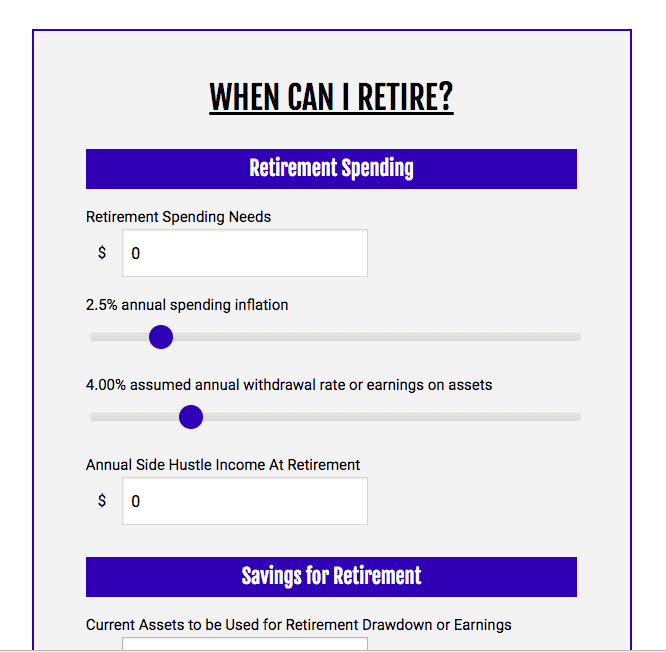

Let’s find out! I discovered this retirement calculator on Independence day and when I entered my digits, it told me I was already at my Phase 2 numbers. Seeing that made my Independence Day celebration a whole lot more meaningful. It doesn’t change anything for me right now as I’ll continue to consult and earn for a few more years, but knowing that I could “phase 2’er” at any time with just a small side hustle income to meet my financial needs is pretty freeing.

Click on the image to head to the calculator.

Even if you’re nowhere close to your Phase 2 life, I think this is a really helpful tool for understanding not only how far you’re off, but also how the power of building a side hustle as you earn a full-time salary can really accelerate your timeline. Sure, you might be 15 years away from full retirement, but what if you had a small business on the side that kicked off 15K per year? If your living expenses were low enough (another great acceleration tactic), that could shave years off your time in your professional job.

[bctt tweet=”How to factor your side hustle income into your early retirement plans #sidehustle #retireat40″ username=”fundinghappy”]

I hear a lot of people bemoan the slog of their full-time jobs and I totally understand that feeling. It can be a soul-sucking experience. But very often we think only of escaping one soul-sucking job for another one. Why not instead take some time to consider how long it would take for you to save up enough that you could ditch the corporate gig once and for all? Or at least go down to part-time so that you can start prioritizing your life instead of your job.

Just some food for thought. Remember, anything… absolutely anything is possible.

Leave a Comment