Head's up, there could be affiliate links ahead!

Impact-Site-Verification: 877591058

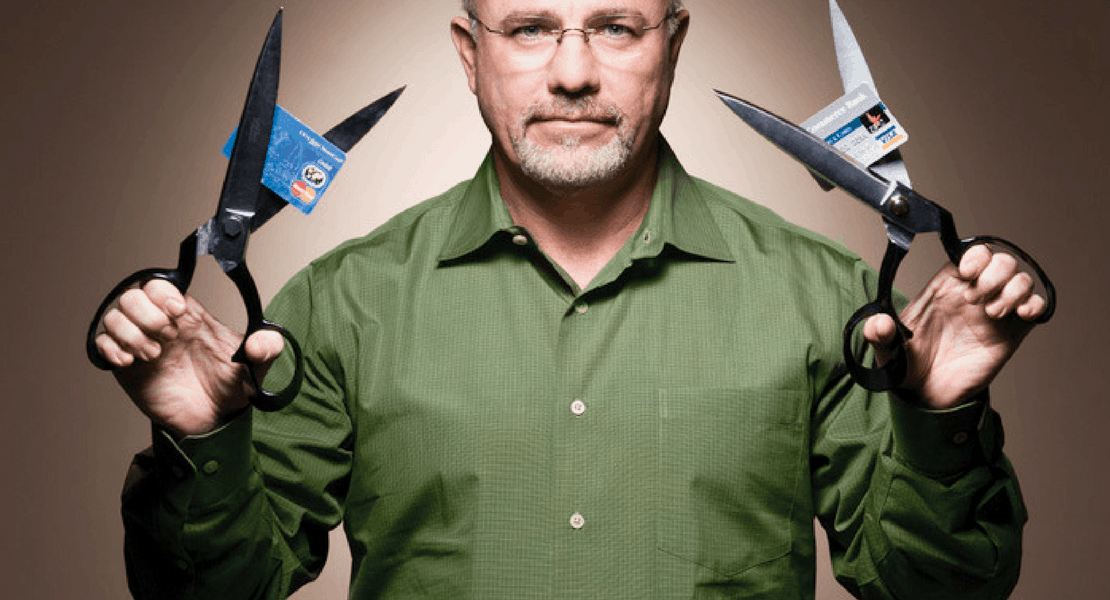

In my quest for seeking out money mentors, I naturally checked out Dave because so many people swear by him, but man, I just can’t. I bet some of you LOVE this guy and you’re going to send me ranty emails about being ungrateful or unGodful or whatever, but hear me out.

Religion and Money Aren’t Topics I Want to Explore Together

I understand the connection between money and religion – both boil down to values and how we contextualize the choices in our lives. So if you’re a person of faith, I can understand why Dave Ramsey might resonate so well. He talks a lot about God, Jesus and his podcast can sound very much like a sermon.

But if you’re someone who just just wants the straight up money coaching, the constant references to religion are distracting and almost alienating. So the first thing to know about Mr Ramsey is that if you’re not a Christian, you’re really not his target audience.

Dave Ramsey’s Advice Doesn’t Make Financial Sense

I also take issue with his idea of paying off your home as a sound financial tactic (at least for those of us living in America). If you are living here, you have an amazing opportunity to write off the interest you pay on your mortgage. That’s a huge tax advantage that I think is worth leveraging, especially given how low mortgage rates have been over the last 10 years. Meanwhile, those funds that you’re not putting toward the capital of your home could be better used making 7% or more in index funds.

Pay down a 4% tax-deductible mortgage or invest in an index fund with 7% (or more) in returns – which do you think is going to get you to financial freedom quicker? I know there are some cases where paying down a mortgage makes sense, but for most Americans, that money will work harder in other places.

I also feel like tying up too much of your net worth in your home can be a very risky investment. Homes have little liquidity unless you borrow against it, so if all your money eggs are in your home basket and the market tanks – you’ve got problems if you need to sell.

Finally, while I do think paying off your debt is important, I think prioritizing paying off the higher interest debt rather than the small debt makes a bit more sense. I can understand the psychological benefits to seeing small debts go away, but the higher interest stuff is still out there snowballing at a much faster rate.

Personally, I’d rather focus on avoiding an avalanche that might take me out rather than the little hand-size snowballs that might ruin a good hair day at worst.

Anyway, I’m not a financial expert by ANY means, but those are my thoughts.

TJ says

It’s worth noting that you need a pretty pricey house (and/or to live in a state with high state income tax) to benefit from the mortgage deduction.

One of the reasons I rented out my condo for a couple years, rather than live in it, was because the interest and property taxes weren’t enough to take me over the standard deduction, plus my HOA fees magically became deductible too when it was turned into a rental. 😀

A lot of people ARE debt averse, it’s definitely irrational in financial terms, but I guess it’s better than the opposite of over-leveraging like so many have done. I’d rather have the cash than a paid off house in the event of a job loss, but everyone’s diffferent.

Yo thats me says

Good points TJ. I live in the Bay Area where a million dollar mortgage is common for starter homes. It’s a little nutty here, so it’s crazy not to take advantage of that tax break. That said, if I lived in a small town/city where I could buy a home for 200K outright, I would.

Nice to e-meet!

ESI Money says

To the best of my knowledge, Dave has never said:

1. Your financial status impacts your proximity to God.

2. That God only rewards nice/good people.

And I know the Bible does not say this. So I think you’re arguing against someone/some principle that no one is suggesting.

But the Bible is full of good financial advice — much of what we consider “common sense” these days: be careful of debt, save for the future, diversify your assets, etc.

It also has a healthy dose of giving/helping others, which you might imagine.

If you’re interested in learning more, shoot me a note and I’ll send you some suggested books to read.

caren says

Hi there,

Thanks for your comment!!

To be clear, I’m debating the philosophical question of religion and finances in general. I am not directly quoting the bible or Dave. Perhaps I should have worded my question differently, but my point is that religion is based on the idea that good behavior is appropriately rewarded. This can be dangerous in the case of personal finance because if you think God is granting individual stewardship of “his resources” (something Ramsey talks a lot about), then it implies to some degree that God decides how much wealth you should have. According to Dave, “we are called to manage God’s money”: http://www.daveramsey.com.edgesuite.net/greatrecovery.com/resources/downloads/momentum/3_godownsitall.pdf

I know some people love Dave Ramsey, and that’s wonderful. Personally, I think his dogmatic approach is really unappealing.

Vee says

Oh dear, I am going to be “that person” who is defending Dave Ramsey 🙂 I grew up Southern Baptist and its super easy for me to hear his message, to even hear inclusion and acceptance in his message, because its my home culture and I get where he’s coming from with his general tone. It’s a sad reality for me that his style is a turn off for some, because I reallllly like what he’s trying to do in general. You’re probably aware that most of his ideas have to do with altering behavior instead of being the most brilliant financial advice by the numbers. For our early marriage, this was a GAME-CHANGER and even though we don’t follow his stuff to the letter, having such a strong point of view to reference was a great place to start. (We’re still debating the mortgage pay off issue.) I can see for engineering/left brained people that his stuff wouldn’t make sense, but for most average folks who are just struggling with discipline or motivation, I would highly recommend at least listening to the podcast for a week or so to get a feel for the message, unless his style is such a turnoff you can’t handle it. As for the faith/money piece, as a faith based person, I think any domain of life is connected to my faith. It makes sense to me that there is relationship and interplay there. Kind of like yoga practice influences my mental health. They are not one and the same, but they are intrinsically related. I have a strong desire to manage money well so that I can impact social causes and even just become more generous to friends and family. To me (can’t speak for others), that’s definitely related to faith.

Like Dave Ramsey, I’m glad you’re putting strong opinions out there! I like bumping up against authentic thoughts and wrestling through them.

caren says

Vee! Thank you so much for your thoughtful comment. You are 100% right about Ramsey being a behavior-changer rather than a technical finance advisor. And yes, you’re right that he has his place in the world. I don’t disregard his value (he’s clearly doing very well and changing lives, so I can’t argue that), it’s his dogma that I find so hard to listen to. I tried to listen to his podcast for a while. I tried hard to overlook the religious undertones and the preachy nature of his approach because I wanted to hear his financial advice, but I just couldn’t. 🙁

But that’s okay. There’s a horse for every saddle and he and I just aren’t meant for each other. That’s the beauty of the internet. There’s enough room for everyone 🙂

Nice to e-meet you!

Claire says

My main concern isn’t the financial sense of his advice, to be honest. I understand that for most people, (overly) simple maxims are better than the alternative, which is the standard high-debt, high-consumption life most people lead. But as a queer woman, I have concerns that his strict religious approach excludes some people from the wider message. I had read that his Financial Peace University didn’t allow same-sex couples to use the couples discounts and I’m not sure if I have ever seen a queer couple take part in the debt-free scream. I really hope I’m wrong and he’s welcoming of couples in all forms, because many queer couples are in need of financial advice. For example, they often gravitate towards expensive cities to meet other LGBT people, or they may lack family support or face barriers when trying to secure well-paid jobs.

caren says

Claire, lovely to meet you! One of my strong oppositions to dogmatic Christian faith is the exclusion of others that don’t fit the mold. Not all christian faiths are like that, but Ramsey is a right-leaning christian, so although I don’t know what his personal views are on LGBT, I doubt they would be enthusiastically welcoming.

With that said, there are fortunately lots of people sharing great financial advice out there without the religious dogma, so one doesn’t have to look too far to find good information. The kicker is that often people need to be inspired to explore the topic of personal finance. Ramsey has done a great job raising awareness from his segment of the population.